Introduction

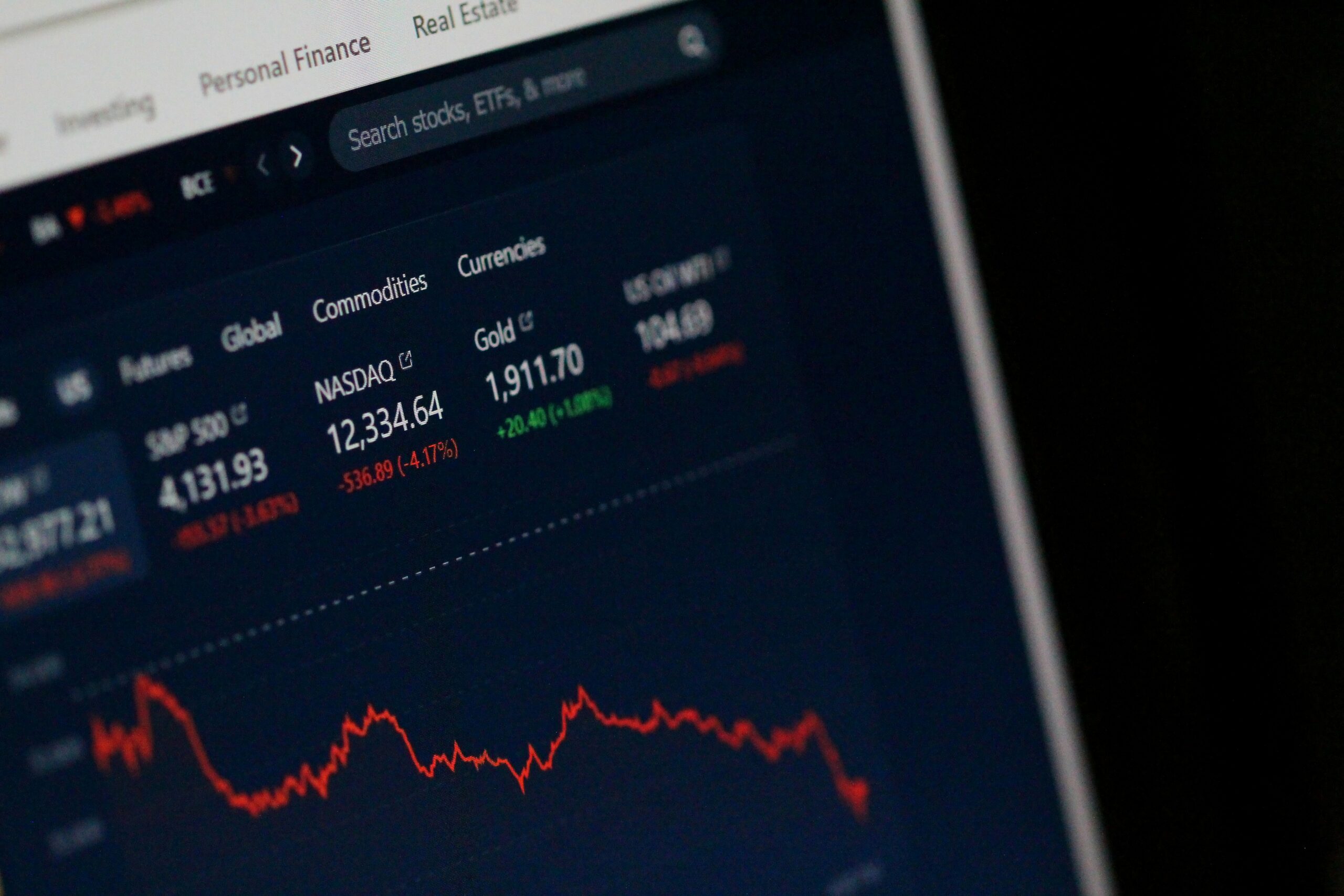

If you’ve been following the cryptocurrencies today, you might be asking yourself, “Why is the crypto market down?” Various factors are at play, but two major contributors are tariff worries and concerns over potential rate cuts. In this article, we will delve into these issues and how they impact the cryptocurrency landscape.

Tariff Worries Impacting Investor Sentiment

Tariffs have long been a source of uncertainty in global markets. Recent announcements regarding increased tariffs on imports have led to fears of escalating trade tensions. This concern extends to the crypto market, where investors typically react to broader economic signals. As tariffs rise, fears of a recession can prompt sell-offs in riskier assets, including crypto.

Concerns Over Rate Cuts

Additionally, recent discussions around potential rate cuts have created a shaky environment for investors. While lower interest rates can stimulate economic growth, fears of a rate cut may also signal underlying economic weaknesses. This sentiment often leads to reduced confidence in financial markets, including cryptocurrencies. Investors may liquidate their assets to minimize exposure, further contributing to the downward trend.

Conclusion

In summary, today’s downturn in the crypto market can be attributed to tariff concerns and potential rate cuts. The interplay of these economic factors contributes significantly to investor sentiment, causing fluctuations in crypto values. Staying informed about these issues can help investors navigate the ever-evolving landscape of the cryptocurrency market.