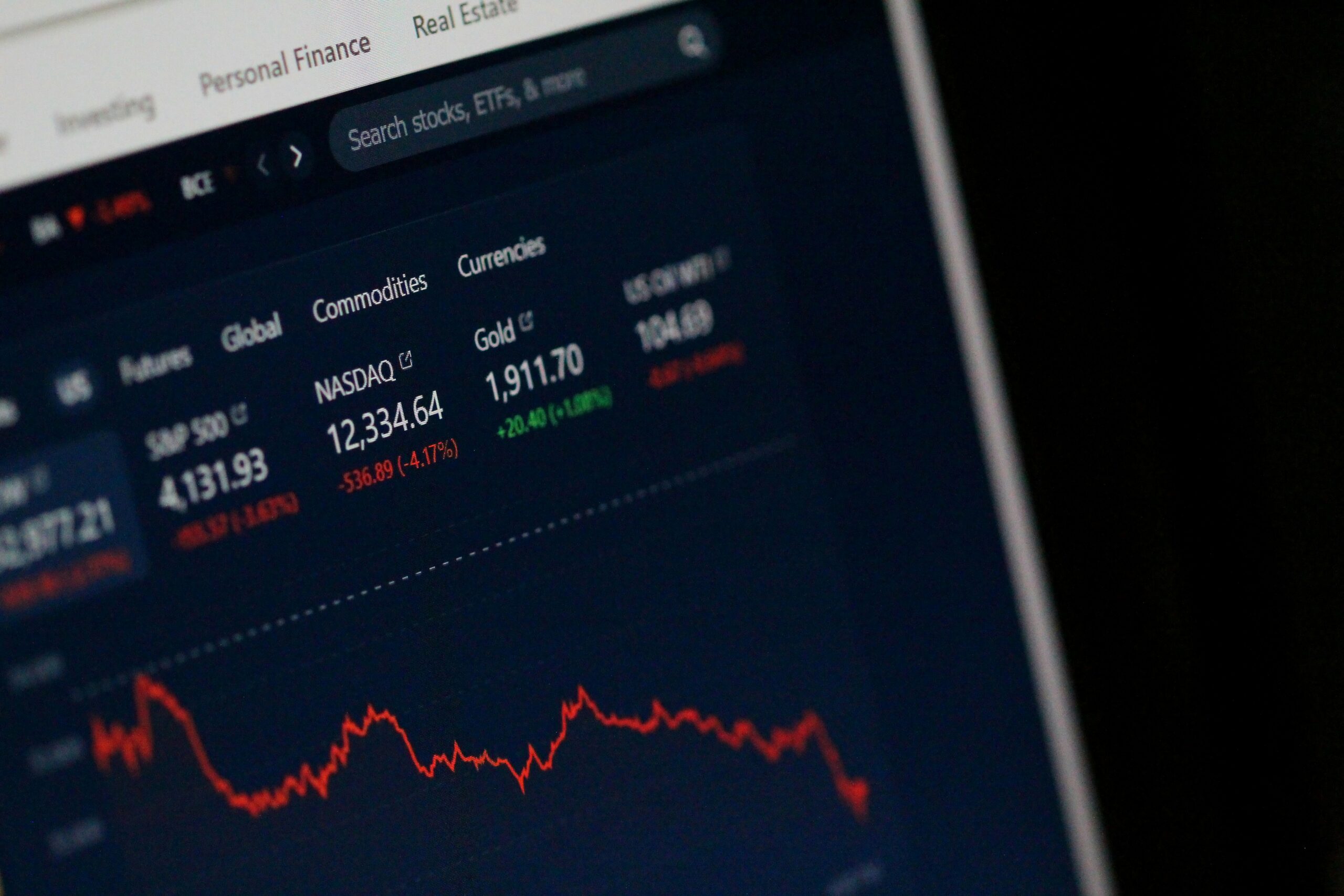

The Impact of the Latest NFP Report

The recent Non-Farm Payroll (NFP) report has clearly reinforced Wall Street’s sentiment regarding the Federal Reserve’s stance on interest rates. With the new data indicating that the U.S. economy added just 50,000 jobs, falling short of the forecast of 70,000 and showing a revision from the previous count of 64,000, traders are now more convinced that the Fed will approach rate cuts with caution.

Market Reactions: Currency and Stocks

Following the release of the NFP report, the U.S. dollar quickly erased earlier gains, indicating a shift in investor sentiment regarding the currency. Meanwhile, U.S. stock futures advanced, suggesting that investors are embracing equity markets despite the slower job growth. The market pricing in a near-zero chance of a Fed rate cut in January also reflects the uncertainty surrounding future monetary policy decisions.

International Developments: Japan’s Economic Strategy

Beyond American borders, significant developments are occurring in Japan, where Finance Minister Takaichi is contemplating dissolving the lower house, as reported by Yomiuri. Following these announcements, the Japanese yen weakened, demonstrating how geopolitical events can influence currency valuations alongside domestic economic indicators.

In summary, the latest data from the NFP report keeps Treasuries under pressure, while the broader financial markets reflect cautious optimism as investors navigate the current economic landscape.