Introduction to Ethereum Spot ETFs

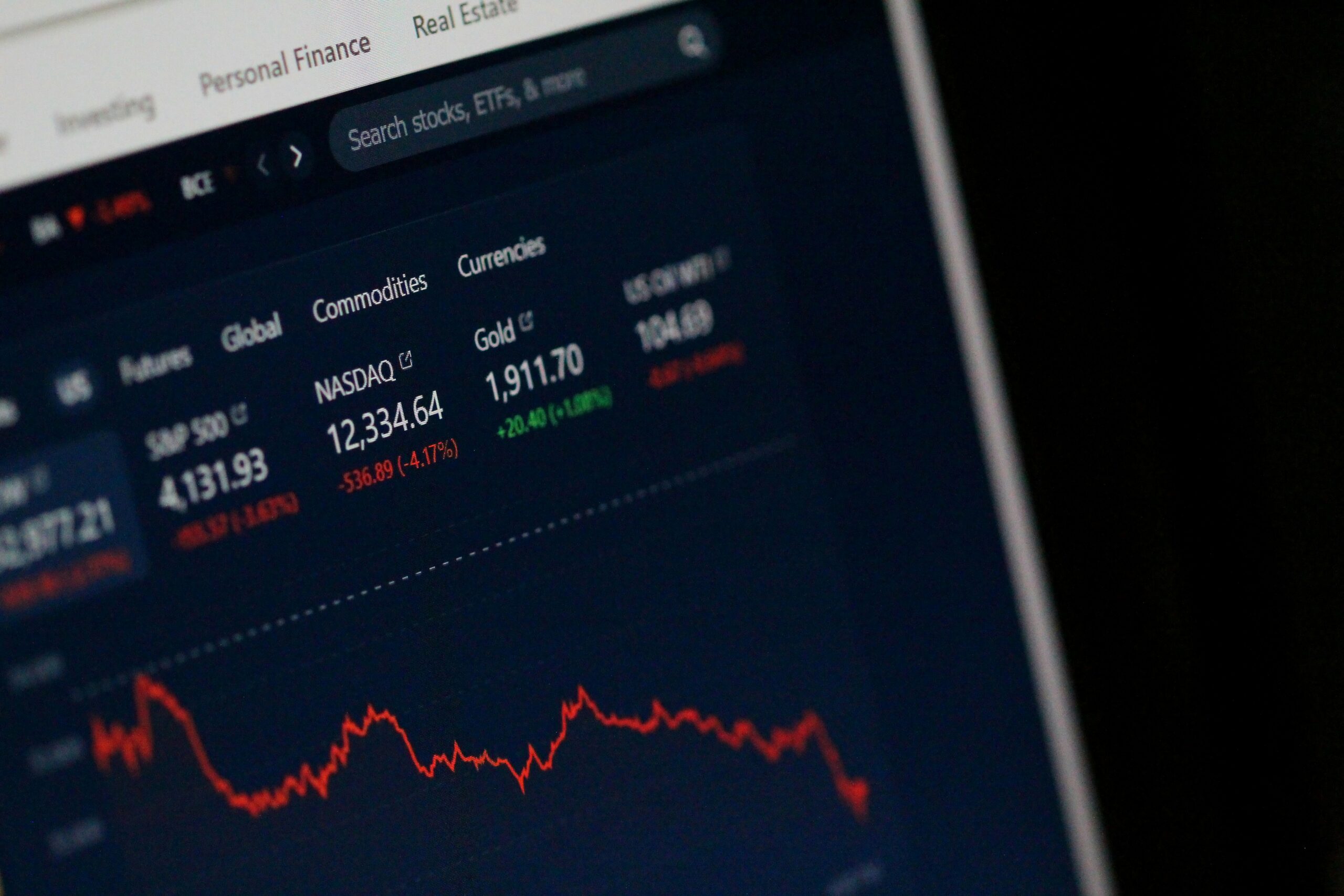

Exchange-traded funds (ETFs) have gained considerable traction in the investment world, particularly within the cryptocurrency sector. Recently, the U.S. Ethereum spot ETF has made headlines by achieving a remarkable net inflow. This development not only highlights the increasing interest in digital assets but also marks significant shifts in the management of investment portfolios.

Breaking Down the Recent Net Inflow

On the previous day, the Ethereum spot ETF recorded an impressive net inflow of $17.11 million. This inflow signifies a robust demand for Ethereum among institutional and retail investors alike. Such financial movements illustrate a growing confidence in the cryptocurrency, reflecting a broader trend in the investment community as they seek diversified options.

Market Implications and Future Outlook

These substantial inflows into the U.S. Ethereum spot ETF indicate a bullish sentiment in the market. Investors are swiftly recognizing the potential of Ethereum as not just a digital currency but a valuable asset class. As demand increases, experts suggest that this trend may continue, influencing both the price of Ethereum and its surrounding ecosystem. Staying informed and engaged with these changes will be crucial for investors looking to capitalize on the evolving landscape of cryptocurrency ETFs.