Understanding Derivatives in Trading

Trading derivatives has become increasingly popular among investors looking for leverage and risk management. A derivative is a financial contract whose value is based on an underlying asset. Options trading, in particular, allows traders to speculate on the future price movements of assets, making it a powerful tool in one’s trading strategy.

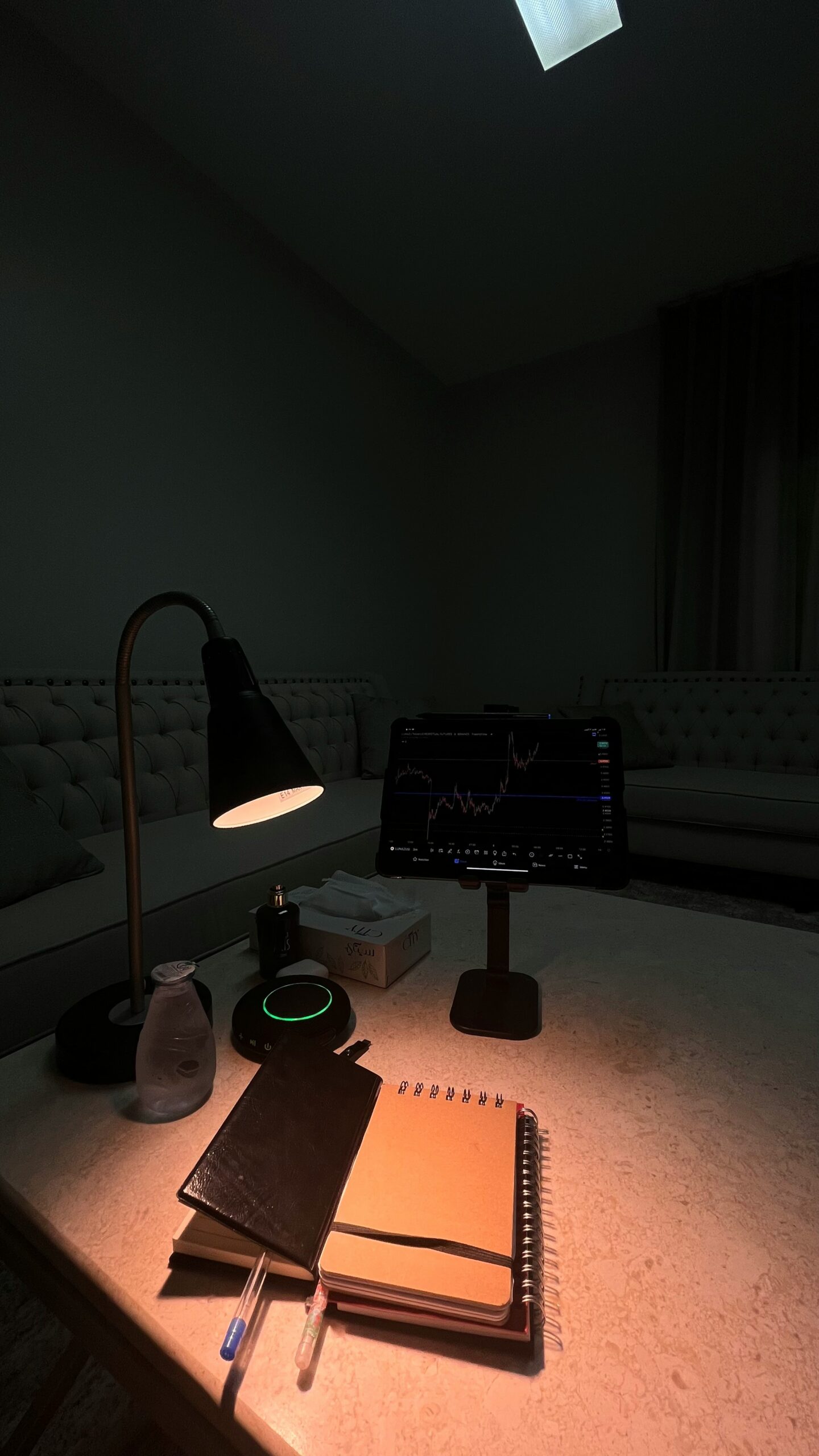

Insights on Indhotel’s 700 Put Option

In this analysis, we are focusing on the derivative pick of Indhotel. Traders are advised to consider buying the Indhotel 700 put option, expiring on October 31. The current market price for this option stands at 16.65, with a stop-loss set at 11, providing a clear exit strategy if the trade does not proceed as anticipated. Importantly, the target profit is set at 24, which offers a favorable risk-reward ratio.

Time Frame and Market Considerations

The estimated time frame for holding this position is between 1 to 10 days. This relatively short duration requires traders to be vigilant about market dynamics affecting Indhotel’s stock price. Given the volatility in the market, it is essential to continuously monitor the economic news and events that might influence trading decisions. By employing this strategic approach, traders can maximize their potential returns in the options market.